Real estate investing can be highly profitable, but only when decisions are backed by accurate data and smart analysis. Many investors struggle with evaluating rental income, estimating expenses, calculating ROI, or comparing multiple properties efficiently. Without the right tools, even experienced investors can make costly mistakes.

This is where DealCheck stands out. It is a powerful real estate analysis platform designed to help investors evaluate rental properties, flips, and BRRRR deals with confidence. From cash flow calculations to cap rate and ROI analysis, DealCheck simplifies complex numbers into clear, actionable insights. Whether you are a beginner or an experienced investor, its intuitive tools make property analysis faster and more reliable.

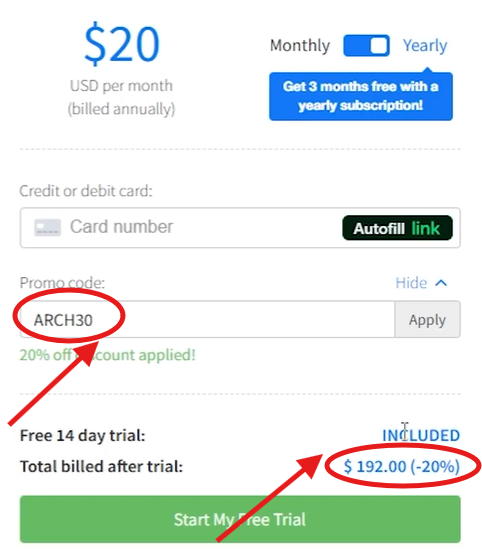

To make it even better, you can now save on your subscription using the DealCheck coupon code “ARCH30”, which gives you a flat 20% discount on paid plans. This exclusive offer helps you access advanced features at a lower cost while improving your investment decisions.

In this guide, you’ll learn how DealCheck works, its key features, pricing, and how it compares to alternatives like BiggerPockets. You’ll also discover how to maximize its tools for smarter investing.

Use the DealCheck coupon code “ARCH30” to get flat 20% off your subscription today by visiting DealCheck.

What Is DealCheck?

DealCheck is a powerful real estate analysis platform designed to help investors evaluate properties quickly and accurately. It simplifies complex financial calculations and turns raw property data into clear insights, making it easier to decide whether a deal is worth pursuing. This DealCheck review highlights why the platform is trusted by thousands of real estate investors worldwide.

At its core, DealCheck real estate analysis focuses on helping users analyze different investment strategies with confidence. Whether you are reviewing a single rental property or comparing multiple deals, the platform provides reliable projections for cash flow, ROI, cap rate, and overall profitability.

DealCheck is ideal for:

Real estate investors looking to analyze deals faster

Agents who want to present clear numbers to clients

Wholesalers evaluating quick investment opportunities

Beginners learning how to analyze real estate deals accurately

Supported investment types include:

Rental properties

Fix-and-flip projects

BRRRR investments

Multi-family properties

Commercial real estate

DealCheck works seamlessly across web and mobile devices, allowing users to analyze deals anytime, anywhere. Whether you are at your desk or visiting a property, you can instantly run numbers and make informed decisions without spreadsheets or complex formulas.

This flexibility, combined with powerful analytics, makes DealCheck a reliable choice for both new and experienced real estate investors.

How DealCheck Works (Step-by-Step )

This DealCheck tutorial for beginners explains exactly how to use DealCheck to analyze real estate deals efficiently. The platform is designed to be beginner-friendly while still offering powerful tools for experienced investors.

Step 1: Create an account

Start by creating your account on DealCheck using a valid email address. Once logged in, you can access the dashboard from both desktop and mobile devices. The setup process is quick, allowing you to start analyzing properties within minutes.

Step 2: Import or enter property data

You can manually enter property details such as purchase price, rent, and location, or import data directly from supported listing sources. This helps speed up the analysis process and reduces manual errors.

Step 3: Add expenses and financing details

Next, include key financial inputs such as renovation costs, mortgage details, property taxes, insurance, and operating expenses. DealCheck automatically calculates totals and adjusts projections based on your inputs.

Step 4: View ROI, cash flow, and projections

Once all data is entered, DealCheck instantly displays important metrics including cash flow, cap rate, cash-on-cash return, and long-term ROI. This helps you quickly identify whether a deal is profitable or not.

Step 5: Save and share reports

You can save your analysis for future reference or share professional reports with partners, lenders, or clients. This feature is especially useful for collaboration and decision-making.

Important note:

Pricing, features, and plan availability may change over time. Always verify current pricing and plan details directly on the official DealCheck website before subscribing. Discounts, including the DealCheck coupon code “ARCH30”, may also vary or expire.

Key Features of DealCheck (In-Depth)

DealCheck offers a powerful set of tools designed to help investors analyze properties with accuracy and confidence. Below is a detailed breakdown of its core features, focusing on usability, accuracy, and real-world investment value.

Rental Property Calculator

The DealCheck rental property calculator helps investors quickly evaluate whether a rental property is profitable. It allows you to input essential data such as purchase price, rental income, expenses, and financing details. The calculator then provides clear financial projections, helping you avoid underperforming investments.

Key benefits include:

Accurate rental income estimation

Automatic expense calculations

Clear monthly and annual cash flow insights

Cap Rate & ROI Calculations

With the DealCheck cap rate calculator and DealCheck ROI calculator, users can instantly measure property performance. These tools are essential for comparing multiple investment opportunities.

You can analyze:

Capitalization rate (cap rate)

Cash-on-cash return

Total return on investment (ROI)

Long-term profitability projections

This makes it easier to choose properties that align with your investment goals.

Cash Flow & Expense Tracking

DealCheck allows users to track all recurring and one-time expenses, including:

Mortgage payments

Property taxes and insurance

Maintenance and management fees

Vacancy and operational costs

The platform automatically calculates net cash flow, giving you a clear picture of monthly and annual performance.

Property Comparison Tools

DealCheck makes it easy to compare multiple properties side by side. This feature helps investors evaluate which deal offers the best returns based on cash flow, ROI, and risk factors. It is especially useful when deciding between similar properties or markets.

Exportable Reports

You can generate and export professional reports that summarize all financial data and projections. These reports are useful for:

Sharing with partners or investors

Presenting to lenders

Keeping long-term investment records

Important note:

Features, tools, and availability may change over time. Always verify the latest features and pricing directly on the official DealCheck website before making a purchase decision.

This in-depth feature set makes DealCheck one of the most reliable real estate analysis tools available for both beginners and experienced investors.

DealCheck Pricing Plans (With Coupon Code)

DealCheck offers flexible pricing options designed for both beginners and professional real estate investors. Whether you are testing the platform or managing multiple properties, there is a plan that fits your needs.

Free Plan Overview

The free plan is ideal for beginners who want to explore the platform before upgrading. It includes:

Basic property analysis tools

Limited deal evaluations

Access to essential metrics for quick decision-making

This plan is useful for learning how the platform works, but advanced tools are restricted.

Paid Plan Benefits

Upgrading to a paid plan unlocks advanced features designed for serious investors. With a premium subscription, you gain access to:

Unlimited property analyses

Advanced DealCheck rental property calculator

Full access to DealCheck cap rate calculator and DealCheck ROI calculator

Detailed cash flow and expense tracking

Property comparison tools

Exportable professional reports

These features allow you to analyze deals faster, compare opportunities accurately, and make data-driven investment decisions.

What You Unlock With Premium

By upgrading, you get:

Deeper financial insights

Faster deal evaluation

Better long-term ROI forecasting

Tools suitable for rental, BRRRR, and commercial investments

Premium plans are ideal for investors who want precision and scalability.

Apply “ARCH30” for 20% Off

You can save on your subscription by using the DealCheck coupon code “ARCH30”, which gives you a flat 20% discount on eligible plans.

Apply the discount directly through the official website:

DealCheck

Important note:

Pricing, features, and discounts may change or vary over time. Always verify the latest subscription details and availability directly on the official DealCheck website before purchasing.

This pricing structure makes DealCheck a flexible and cost-effective solution for both new and experienced real estate investors.

DealCheck Free Plan Features

Understanding the DealCheck free plan features is important before committing to a paid subscription. The free plan provides a solid starting point for new investors or users who want to explore the platform before investing.

What’s Included

The free plan offers access to essential tools that help beginners get familiar with real estate analysis, including:

Basic property input fields

Limited property evaluations

Simple cash flow and ROI calculations

Overview of key metrics without advanced detail

Mobile and web access

These features allow users to run introductory property assessments without upgrading immediately.

Limitations

While helpful for beginners, the free plan has some limitations compared to paid plans:

Restricted number of property analyses

No access to advanced tools like in-depth comparison or exportable reports

Limited use of DealCheck rental property calculator, DealCheck cap rate calculator, and DealCheck ROI calculator

Fewer customization options for expenses and financing inputs

Due to these restrictions, investors may find it challenging to evaluate multiple deals or capture detailed financial projections.

Who It’s Best For

The free plan is best suited for:

New investors testing real estate analysis tools

Beginners learning how to assess property deals

Users who want to explore the platform before committing

Occasional users who analyze only a few properties

If you plan to frequently evaluate rental, BRRRR, or commercial investments, upgrading to a paid plan with the DealCheck coupon code “ARCH30” can unlock powerful features and provide more comprehensive insights.

Important note:

Free plan features and limitations can vary over time. Verify current details on the official DealCheck website before subscribing to ensure you have up-to-date information.

This free plan is a great way to get started, but serious investors often benefit more from premium tools that deliver deeper financial analysis and scalability.

DealCheck vs BiggerPockets Analysis

When comparing real estate analysis tools, a DealCheck vs BiggerPockets analysis helps investors decide which platform best fits their needs. Both tools serve property investors, but they differ significantly in focus, usability, pricing, and overall value.

Ease of Use

DealCheck:

DealCheck is designed for simplicity and speed. Its interface is intuitive, guiding users step by step through property inputs, expense entries, and financial projections. This makes it especially suitable for new investors, as well as experienced users who want fast deal evaluations.BiggerPockets:

BiggerPockets provides a broader suite of real estate resources, including forums, educational content, and community insights. Its calculators are useful, but the overall platform can feel overwhelming for beginners due to the variety of features and navigation paths.

Winner: DealCheck for streamlined analysis; BiggerPockets for community and education.

Pricing

DealCheck:

Offers a free plan with basic features and affordable subscription plans for advanced analysis tools. Users can save using the DealCheck coupon code “ARCH30” for a flat 20% discount on premium plans. Paid plans unlock powerful calculation tools and unlimited property evaluations.BiggerPockets:

BiggerPockets offers both free and paid memberships. Premium access includes additional calculators and tools, but may require upgrades for deeper functionalities. The pricing structure can be more complex, with tiered memberships and add-ons.

Winner: DealCheck for transparent pricing and straightforward value.

Accuracy

DealCheck:

Known for precise real estate metrics, including cash flow, DealCheck rental property calculator, DealCheck cap rate calculator, and DealCheck ROI calculator. Its automated projections reduce errors and provide clear financial snapshots.BiggerPockets:

Provides reliable tools, but users often manually input more data and may need spreadsheets to supplement detailed analysis. Accuracy can depend more on user input and additional resources.

Winner: DealCheck for automated, highly accurate calculations.

Best for Beginners vs Advanced Investors

Beginners:

DealCheck’s user-friendly setup and clean analytics make it ideal for those new to real estate investing. The step-by-step workflow helps users understand key metrics without confusion.Advanced Investors:

BiggerPockets appeals to seasoned investors who value community discussions, expert insights, and broader educational resources. However, for pure deal analysis, many still prefer DealCheck’s focused tools.

Overall Recommendation:

For pure real estate analysis and quick financial insights, DealCheck is often more efficient and beginner-friendly. For a comprehensive learning environment with networking potential, BiggerPockets offers additional value — but may require more effort to extract deep analytical insights.

This DealCheck vs BiggerPockets analysis shows that both platforms have strengths, but DealCheck stands out for accuracy, pricing clarity, and ease of use.

How to Use DealCheck for BRRRR Strategy

The BRRRR strategy (Buy → Rehab → Rent → Refinance → Repeat) is one of the most effective ways to scale a real estate portfolio. Understanding how to use DealCheck for BRRRR can help investors accurately project returns, minimize risk, and optimize long-term cash flow.

Buy → Rehab → Rent → Refinance → Repeat

DealCheck allows you to model each stage of the BRRRR strategy clearly and efficiently:

Buy:

Enter the purchase price, closing costs, and acquisition expenses to evaluate whether the deal meets your investment criteria.Rehab:

Add renovation and repair costs to calculate total investment value. This helps determine if the property will meet your target returns after improvements.Rent:

Input expected rental income and operating expenses. DealCheck automatically calculates monthly and annual cash flow to assess rental profitability.Refinance:

Estimate post-rehab value (ARV) and refinancing terms to understand how much capital you can pull out while maintaining positive cash flow.Repeat:

Use the saved data to replicate successful deal structures and scale your investment portfolio efficiently.

ROI and Cash Flow Modeling

DealCheck makes it easy to evaluate long-term profitability by automatically calculating:

Cash-on-cash return

Annual and monthly cash flow

Return on investment (ROI)

Break-even timelines

These insights help investors decide whether a BRRRR deal supports long-term wealth growth.

Refinancing Projections

The platform allows you to test multiple refinancing scenarios, including different interest rates, loan terms, and refinance amounts. This helps determine:

How much capital can be recovered

Whether the property remains cash-flow positive

How quickly you can move on to the next deal

Using DealCheck for BRRRR analysis removes guesswork and replaces it with data-driven decision-making, making it easier to scale your real estate portfolio with confidence.

Best Real Estate Investment Tools (Why DealCheck Stands Out)

When evaluating the best real estate investment tools, DealCheck consistently ranks among the top solutions for both beginners and experienced investors. Whether you’re comparing it to spreadsheets or other platforms, DealCheck offers a compelling combination of accuracy, ease of use, and advanced features.

Why DealCheck Outperforms Spreadsheets

Many investors rely on spreadsheets for property analysis, but spreadsheets have limitations:

Manual data entry increases the risk of errors

Formulas can become complex and hard to audit

Updating scenarios requires significant time and expertise

DealCheck eliminates these challenges by automating calculations with built-in financial models. With tools like the DealCheck rental property calculator, DealCheck cap rate calculator, and DealCheck ROI calculator, you get accurate projections instantly without building formulas from scratch.

Compared to Other Tools

While there are other platforms and software aimed at real estate investors, DealCheck stands out for its focus on actionable analysis rather than general real estate information. Some alternatives may offer additional features like market data or community forums, but few match DealCheck’s analytical precision and clean interface. Its results are clear, consistent, and tailored to investor decision-making, making it a reliable choice compared to other tools in the market.

Time-Saving Benefits

DealCheck dramatically reduces the time required to assess investment opportunities:

Enter property details once and run multiple scenarios

Quickly compare different deals side by side

Generate professional reports in seconds

This efficiency makes DealCheck especially valuable for investors who evaluate multiple properties or need fast insights for decision-making.

Overall, DealCheck is among the best real estate investment tools available today. Its combination of accuracy, automation, and simplicity makes it superior to spreadsheets and highly competitive compared to DealCheck alternative software options. If you’re serious about analyzing investments faster and more reliably, DealCheck offers a powerful, streamlined solution.

Pros & Cons of DealCheck

A balanced look at DealCheck helps investors understand where the platform excels and where it may have limitations. Below is an honest and practical breakdown to help you decide if it fits your investment needs.

Pros

Easy to use

DealCheck is designed with simplicity in mind. Its clean layout and guided inputs make it easy for beginners to analyze deals without confusion.Accurate analysis

The platform delivers reliable calculations for cash flow, ROI, and cap rate, helping investors make data-driven decisions with confidence.Mobile-friendly

DealCheck works smoothly across desktop and mobile devices, allowing users to analyze properties on the go.Affordable pricing

Compared to many real estate tools, DealCheck offers strong value for money, especially when using the DealCheck coupon code “ARCH30” for a discounted subscription.

Cons

Limited international data

DealCheck is primarily optimized for U.S.-based real estate analysis, which may limit accuracy for international property markets.Advanced users may want deeper customization

While DealCheck covers most investment scenarios, advanced users may want more granular control over financial modeling or custom assumptions.

Overall, DealCheck strikes a strong balance between usability, accuracy, and affordability. It’s an excellent choice for beginners and intermediate investors, while advanced users may still find it highly valuable for fast, reliable deal analysis.

Who Should Use DealCheck?

DealCheck is designed for a wide range of real estate professionals and investors. Its flexible tools and easy-to-use interface make it suitable for both beginners and experienced users across different roles.

Beginners

DealCheck is an excellent starting point for beginners who are learning how to analyze real estate deals. The platform simplifies complex calculations and presents results in a clear, easy-to-understand format. New investors can confidently evaluate properties without needing advanced financial knowledge.

Professional Investors

Experienced investors benefit from DealCheck’s accurate projections, ROI calculations, and deal comparison tools. It allows professionals to quickly assess multiple opportunities, optimize investment strategies, and make data-driven decisions with confidence.

Real Estate Agents

Real estate agents can use DealCheck to present clear financial insights to clients. The platform helps explain potential returns, cash flow, and investment value in a professional format, making it easier to build trust and close deals.

Wholesalers

Wholesalers can use DealCheck to quickly evaluate properties, estimate profitability, and share deal breakdowns with buyers. Its fast analysis tools help identify strong opportunities without spending hours on manual calculations.

Overall, DealCheck serves a wide audience by offering practical tools for anyone involved in real estate investing, from first-time buyers to seasoned professionals managing multiple deals.

Is DealCheck Worth It? (Final Verdict)

After a comprehensive DealCheck review, it’s clear that DealCheck offers strong value for real estate investors of all levels. Whether you are just starting out or managing multiple properties professionally, the platform provides accurate analysis, intuitive tools, and time-saving features that traditional spreadsheets and many alternative tools simply can’t match.

Value for Money

DealCheck delivers powerful functionality without overwhelming complexity. The free plan lets beginners explore basic features, while premium plans unlock advanced tools such as:

Detailed cash flow analysis

DealCheck rental property calculator

DealCheck cap rate calculator

DealCheck ROI calculator

Property comparison and exportable reports

This depth of analysis helps users make smarter decisions faster. When paired with a DealCheck subscription discount, the cost becomes even more attractive for investors who plan to evaluate multiple deals or scale their portfolio over time.

Best Use Cases

DealCheck is particularly effective for:

New investors learning how to analyze deals

Professional investors assessing multiple properties

Agents presenting financial insights to clients

Wholesalers vetting opportunities quickly

BRRRR strategy analysis with refinance projections

Its ability to handle a variety of investment types makes it a versatile choice across different real estate strategies.

Why the “ARCH30” Code Makes It Worth Trying

The “ARCH30″ coupon code provides a flat 20% off eligible subscription plans, making premium features more affordable right from the start. For users on the fence about upgrading, this discount reduces the upfront commitment while unlocking full analytical power.

Apply the discount directly at DealCheck to experience the full range of tools without paying the full price.

In summary, DealCheck is worth trying for anyone serious about real estate investing. With powerful analytics, intuitive design, and a strong DealCheck subscription discount through the “ARCH30” code, it’s a cost-effective tool that can help improve your investment decisions and financial outcomes.

Final CTA – Get Started With DealCheck Today

If you’re serious about making smarter real estate investment decisions, now is the perfect time to get started. DealCheck gives you the tools you need to analyze deals accurately, reduce risk, and improve long-term profitability.

Use the DealCheck coupon code “ARCH30” to get a flat 20% off your subscription.

This limited discount makes it easier to access powerful features like ROI analysis, cash flow projections, and investment comparisons without paying full price.

You can start risk-free and explore the platform at your own pace before committing long term.

Get started here:

DealCheck

Whether you’re a beginner or an experienced investor, DealCheck helps you make confident, data-driven decisions — and with the “ARCH30″ discount, there’s no better time to try it.

Conclusion

DealCheck is a reliable and user-friendly real estate analysis platform that helps investors make smarter decisions with confidence. Throughout this DealCheck review, we’ve seen how its tools — including the DealCheck rental property calculator, DealCheck cap rate calculator, and DealCheck ROI calculator — simplify complex financial evaluations and save you time compared to spreadsheets or other alternatives.

Whether you are just starting out or have years of experience, DealCheck’s intuitive interface and detailed projections make it one of the best real estate investment tools available. The free plan lets you explore basic features, and upgrading unlocks advanced analytics, property comparisons, and professional reporting.

If you are ready to elevate your investment analysis, you can take advantage of the DealCheck coupon code “ARCH30” to get a flat 20% off your subscription. This DealCheck subscription discount makes it even more compelling to adopt the platform as a core part of your workflow.

Start improving your deal evaluations today with this link:

Try DealCheck with discountWith powerful features and a strong emphasis on clarity and accuracy, DealCheck is a tool worth considering for serious real estate investors.

Frequently Asked Questions (FAQs)

1. Is DealCheck free?

Yes, DealCheck offers a free plan with basic tools for property analysis. However, advanced features such as detailed ROI calculations and comparison tools require a paid plan.

2. Does DealCheck work for rental properties?

Yes, DealCheck is highly effective for rental property analysis. It includes tools like the DealCheck rental property calculator to evaluate cash flow, expenses, and profitability.

3. Can I cancel my DealCheck subscription anytime?

Yes, you can cancel your subscription at any time. There are no long-term commitments, making it a flexible option for investors.

4. Is DealCheck good for beginners?

Yes, DealCheck is beginner-friendly. Its clean interface and guided inputs make it easy for new investors to understand deal analysis without technical knowledge.

5. Does DealCheck support BRRRR strategy analysis?

Yes, DealCheck supports BRRRR analysis by helping users calculate rehab costs, rental income, refinancing projections, and long-term ROI.

6. Is DealCheck accurate for real estate analysis?

DealCheck provides accurate calculations for ROI, cap rate, and cash flow based on user input. It is widely trusted for dependable DealCheck real estate analysis.

7. What makes DealCheck better than spreadsheets?

Unlike spreadsheets, DealCheck automates calculations, reduces human error, and saves time with built-in formulas and visual reports.

8. Can I use DealCheck on mobile devices?

Yes, DealCheck works on both desktop and mobile browsers, allowing you to analyze deals anytime and anywhere.

9. Is there a discount available for DealCheck?

Yes, you can use the DealCheck coupon code “ARCH30” to get a flat 20% discount on eligible subscription plans.

10. Where can I sign up for DealCheck?

You can get started directly through the official website using this link:

DealCheck

DealCheck Coupon Code

Sign up using the referral code below and Get Flat 20% Off Subscription Plan!