SureLeverageFunding is a modern prop trading firm designed for traders who want fast access to capital without long waiting periods or restrictive payout rules. Whether you are a beginner looking to prove your skills or an experienced trader aiming to scale, SureLeverageFunding offers flexible challenges and instant funding options that make getting started much easier compared to traditional prop firms.

By using the SureLeverageFunding Referral Code, traders can unlock an exclusive 10% discount on trading fees, reducing the overall cost of entering a funded account. This sureleveragefunding discount code is especially useful for those planning to take multiple challenges or upgrade their account size over time. The platform supports structured evaluations, clear trading rules, and competitive profit splits, making it a strong choice for anyone searching for an instant prop firm account.

Another standout feature is the availability of challenges tailored to different trading styles, along with the potential for on-demand payouts once conditions are met. If you’re looking for a reliable prop firm that balances flexibility, speed, and cost savings, SureLeverageFunding is worth considering. You can apply the referral code during signup through the official SureLeverageFunding website to activate the discount instantly.

What Is SureLeverageFunding?

SureLeverageFunding (often referred to as SLF) is a proprietary trading firm that provides traders with access to funded accounts after completing a structured evaluation process. Instead of trading with personal capital, traders use the firm’s funds and earn a share of the profits while following predefined risk rules. This model makes SLF appealing to traders who want to scale faster without risking large upfront capital.

The SLF prop firm is suitable for a wide range of traders, including those who trade forex pairs, stock indices, and cryptocurrencies. Its flexible account options and clearly defined rules allow both short-term and swing traders to participate. Many SLF prop firm reviews highlight the straightforward setup and the availability of different account sizes, which helps traders choose a challenge that matches their experience level and strategy.

One common question new traders ask is the difference between a prop firm and a broker. A broker provides access to markets using your own money, while a prop firm like SureLeverageFunding allows you to trade the firm’s capital after passing a Slf challenge. Profits are then split between the trader and the firm, reducing personal financial risk.

SureLeverageFunding is available to traders globally, making it accessible regardless of location, subject to standard compliance rules. Some traders also describe the evaluation structure as a learning-style pathway, similar to a Sure Leverage Funding course, where discipline, consistency, and risk management are rewarded rather than aggressive trading.

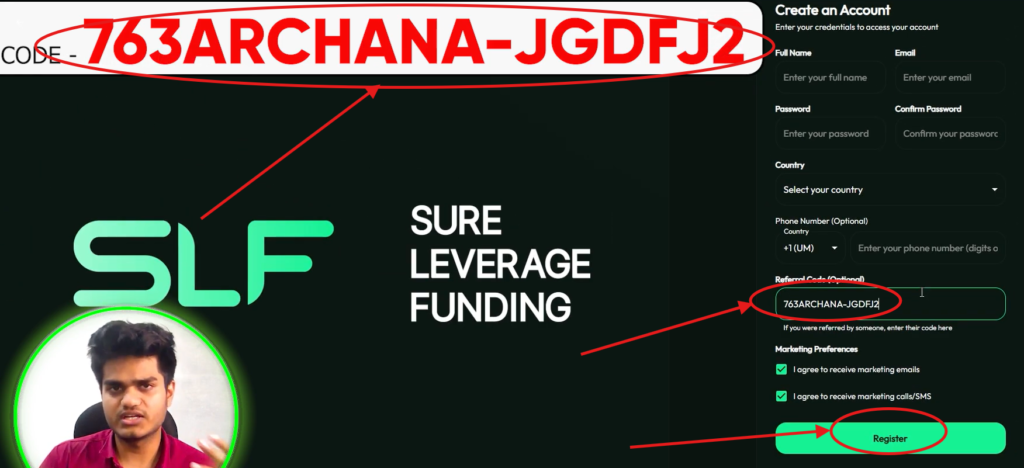

SureLeverageFunding Referral Code – How to Get 10% Discount" (Step-by-Step)

Applying the SureLeverageFunding Referral Code is a simple way to reduce your signup cost when purchasing a challenge or instant funded account. By using the code “763ARCHANA-JGDFJ2″, traders can access a 10% fee discount, making it one of the most reliable savings options currently available. This sureleveragefunding discount code works across eligible plans and is commonly listed as a Top Sure Leverage Funding Coupon Code for new users.

Step 1: Visit the Official Website

Begin by visiting the official SureLeverageFunding website through this secure signup page:

SureLeverageFunding official website

Step 2: Choose a Challenge or Instant Funding

Select the SLF challenge or instant prop firm account that matches your trading style, preferred markets, and account size. Different plans are available, and fees may vary depending on the option you choose.

Step 3: Apply the Referral Code at Checkout

At checkout, enter the SLF coupon code “763ARCHANA-JGDFJ2” in the referral or promo code field. The discount will be applied automatically before payment.

Note: Prices, fees, and discount availability may change over time. Always verify the final pricing and applied discount on the checkout page before completing your purchase.

SureLeverageFunding Account Types Explained

SureLeverageFunding offers multiple account types designed to suit traders with different experience levels, risk tolerance, and funding goals. The two main options are SLF Challenge Accounts and Instant Prop Firm Accounts. Each model follows clear rules while allowing traders to scale using firm capital rather than personal funds.

SLF Challenge Accounts

SLF Challenge Accounts are evaluation-based accounts where traders must meet predefined performance criteria before receiving a funded account. These challenges may be structured as one-step or multi-step challenges, depending on the selected plan. Traders are typically required to reach a specific profit target while respecting daily and overall drawdown limits.

Risk management plays a central role in the Slf challenge. Maximum loss rules, consistency requirements, and trading-day limits are designed to ensure disciplined trading rather than high-risk behavior. These accounts are ideal for traders who are confident in their strategy, comfortable following structured rules, and willing to pass an evaluation in exchange for larger capital access and long-term scalability.

SLF challenge accounts are commonly chosen by traders looking for lower upfront costs and a traditional prop firm pathway.

Instant Prop Firm Account

An instant prop firm account allows traders to start trading with funded capital immediately, without passing a separate evaluation phase. Instead of proving performance first, traders gain instant access while agreeing to stricter risk rules from day one.

Although there is no formal evaluation, instant funding accounts still enforce drawdown limits, position sizing rules, and consistency guidelines to protect firm capital. This option is best suited for experienced traders who prefer speed, want to avoid multi-step challenges, and are confident in maintaining disciplined risk control.

Both account types offer flexibility, allowing traders to choose a path that best aligns with their experience level and trading objectives.

Trading Rules, Profit Split & Payout System

SureLeverageFunding follows a structured rule system designed to balance trader flexibility with firm-level risk management. While specific conditions may vary by account type and plan, traders generally earn a competitive profit split, often ranging from standard industry levels to higher percentages for consistent performers. Profit split ratios are not guaranteed and should always be verified on the checkout or dashboard before purchase.

Risk management is a core part of the platform. Traders must operate within clearly defined daily and overall drawdown limits, which are in place to protect trading capital and encourage disciplined execution. Breaching these limits may result in account termination, making risk control just as important as profitability. Position sizing, leverage usage, and consistency rules may also apply depending on whether you choose a challenge-based or instant funded account.

Most accounts require a minimum number of active trading days before profits can be withdrawn. This trading days requirement helps ensure that results are achieved through consistent performance rather than short-term luck or high-risk strategies.

One of the key features that attracts traders is the availability of a prop firm with on demand payout options. Once eligibility conditions are met, traders can request payouts without waiting for long fixed cycles. This on-demand payout structure provides greater flexibility and faster access to earnings, especially for traders who rely on regular cash flow.

As always, trading rules, profit splits, and payout terms may change, so reviewing the latest conditions on the official platform is strongly recommended before committing.

Platforms, Markets & Trading Conditions

SureLeverageFunding provides a professional trading environment built to meet the needs of both developing and experienced traders. The firm supports widely used trading platforms such as MetaTrader 5 (MT5), allowing traders to access advanced charting tools, technical indicators, expert advisors, and fast order execution. Using an industry-standard platform also makes the transition easier for traders coming from other brokers or prop firms.

In terms of markets, traders can access a broad range of tradable instruments, including major and minor forex pairs, global stock indices, and popular cryptocurrencies. This multi-asset access allows traders to diversify strategies, adapt to different market conditions, and trade according to their preferred session or volatility profile.

Leverage levels vary depending on the selected account type and instrument. Forex pairs generally offer higher leverage compared to indices and crypto, while stricter limits are applied to more volatile assets. These leverage rules are designed to balance opportunity with risk control and should always be reviewed before trading.

Overall, this setup is best suited for traders who value platform stability, flexible market access, and clear trading conditions. Whether you are a technical trader, news-based trader, or someone running algorithmic strategies, the platform and market structure offered by SureLeverageFunding supports a wide range of trading styles, helping build trust and long-term consistency.

SureLeverageFunding Pros and Cons

Evaluating both advantages and limitations is important before choosing any prop trading firm. Below is a balanced overview to help traders make an informed decision about SureLeverageFunding.

Pros

One of the main benefits is the ability to save on signup costs by using the SureLeverageFunding Referral Code, which provides a discount on trading fees and lowers the initial investment barrier. The firm also offers an instant funding option, allowing qualified traders to access capital without going through a lengthy evaluation process.

SureLeverageFunding supports multiple markets, including forex, indices, and cryptocurrencies, giving traders flexibility to apply different strategies across asset classes. Another strong advantage is the on-demand payout model, which allows eligible traders to request withdrawals without being locked into long payout cycles, improving cash-flow flexibility.

Cons

Like most proprietary trading firms, SureLeverageFunding is not a regulated broker, which is standard within the prop firm industry. Traders should understand that they are trading firm capital under internal rules rather than client funds held by a regulated brokerage.

Additionally, trading rules and risk limits must be followed strictly. Violations of drawdown, consistency, or trading conditions can lead to account termination, even if the account is profitable.

Overall, the firm offers attractive features, but success depends heavily on disciplined trading and rule compliance.

SLF Prop Firm Reviews – What Traders Are Saying

When analyzing SLF prop firm reviews, the overall sentiment from traders tends to be mixed to positive, with many highlighting the firm’s flexible funding options and fast access to capital. Traders who understand the rules and follow a disciplined approach often report a smooth experience, especially with instant funding accounts and payout requests.

Common positives mentioned in SLF prop firm reviews include the availability of multiple markets, clear challenge structures, and the option for on-demand payouts once eligibility requirements are met. Many traders also appreciate the ability to reduce upfront costs by using a referral or discount code, making account entry more affordable compared to some competing prop firms.

On the other hand, some complaints focus on strict rule enforcement, particularly around drawdown limits, consistency rules, and trading day requirements. Traders who fail to fully review the terms sometimes express frustration after violating a rule, even when trades were profitable. Others note that pricing and conditions may change, requiring users to stay updated with the latest guidelines.

These reviews highlight the importance of carefully reading and understanding all trading rules before starting. Like most prop firms, success with SLF depends less on aggressive trading and more on consistency, risk management, and compliance with the firm’s framework.

Is SureLeverageFunding Legit or Safe?

SureLeverageFunding is generally considered legitimate in the sense that it operates as a proprietary trading firm offering funded accounts under clearly defined internal rules. However, like most prop firms, it is not a regulated broker. This distinction is important, as traders are not depositing funds to trade in live markets but are instead participating in a performance-based funding model.

Prop firms operate by setting trading rules, risk limits, and profit targets. Traders who meet these conditions are rewarded with profit splits, while rule violations may result in account termination. This structure allows traders to access larger capital without risking their own funds, but it also requires strict discipline.

Risk awareness is essential. Traders should fully understand drawdown limits, payout conditions, and consistency requirements before starting. Prop firms may not be suitable for beginners who lack risk management skills or traders who prefer unrestricted trading environments. Those unwilling to follow structured rules or accept evaluation-based models should consider traditional brokers instead.

Who Should Use SureLeverageFunding?

SureLeverageFunding is best suited for traders who already have a solid understanding of the markets and a proven trading strategy. Experienced traders who are comfortable following structured rules and managing drawdown limits can benefit the most from the firm’s funded account options.

It is also a good fit for strategy-based traders, including those who rely on technical analysis, price action, or algorithmic systems. Traders who are confident in their consistency and risk control may find the challenge and instant funding models useful for scaling their trading without using large amounts of personal capital. Additionally, traders seeking instant access to trading capital may prefer the instant funding option, which removes the need for lengthy evaluations.

On the other hand, SureLeverageFunding may not be ideal for complete beginners who lack risk management experience or are still experimenting with strategies. It is also unsuitable for anyone expecting guaranteed profits, as trading always involves risk and performance depends entirely on the trader’s discipline and decision-making.

Final Verdict

SureLeverageFunding can be a solid option for traders who understand risk management and want access to funded capital without committing large personal funds. With flexible account types, access to multiple markets, and an on-demand payout structure, the platform is designed to support disciplined and strategy-driven traders.

One of the key advantages is the ability to reduce entry costs by using the SureLeverageFunding Referral Code, which offers a 10% discount on trading fees at signup. This makes it easier to start a challenge or instant funded account while keeping initial expenses lower. Combined with global availability and professional trading platforms, the firm provides a competitive prop trading environment.

If you already have a tested strategy and are comfortable following strict trading rules, using the referral code can be a smart way to begin. You can activate the discount by signing up through the official SureLeverageFunding website and applying the code during checkout.

FAQs – SureLeverageFunding Referral Code “763ARCHANA-JGDFJ2”

1. What is the SureLeverageFunding referral code?

The official SureLeverageFunding Referral Code is “763ARCHANA-JGDFJ2″. This code can be applied during signup to unlock a trading fee discount on eligible accounts.

2. How much discount does the SLF coupon code give?

The SLF coupon code provides a 10% discount on trading fees. The final discounted amount is shown at checkout and may vary depending on the selected account type.

3. Where do I apply the SureLeverageFunding referral code?

You can enter the referral code during checkout after selecting your challenge or instant funded account on the official SureLeverageFunding website.

4. Is SureLeverageFunding an instant prop firm account provider?

Yes, SureLeverageFunding offers instant prop firm account options that allow traders to access funded capital without completing a multi-step evaluation.

5. Does SureLeverageFunding also offer challenge-based accounts?

Yes, traders can choose SLF challenge accounts, which require meeting profit targets and risk rules before receiving a funded account.

6. Does SureLeverageFunding offer on-demand payouts?

SureLeverageFunding supports on-demand payouts once eligibility conditions are met, allowing traders to request withdrawals without long fixed cycles.

7. Is SureLeverageFunding legit or a scam?

SureLeverageFunding is considered legitimate as a prop trading firm. However, like most prop firms, it is not a regulated broker and operates under internal trading rules.

8. Can beginners use SLF challenges?

Beginners can join, but SLF challenges are better suited for traders who already understand risk management and disciplined trading.

9. What markets can I trade with SureLeverageFunding?

Traders can typically access forex, indices, and cryptocurrencies, depending on the account type and trading conditions.

10. Do prices and discount terms stay the same?

No. Pricing, rules, and discount availability may change. Always verify the final cost and applied discount on the checkout page before completing your purchase.

SureLeverageFunding Referral Code

Use the referral code below and Get 10% Discount on Trading Fees!